Advanced options strategies designed for enhanced returns with disciplined risk control.

At Quantum 3 AI, innovation isn’t a department, it’s our DNA. We constantly explore emerging technologies like AI, ML, and quantum computing to engineer smarter, faster, and more impactful solutions for the challenges of tomorrow.

We employ a disciplined hedging approach to preserve capital and reduce volatility in equity portfolios. Through the strategic use of protective puts, collars, and sector rotation, we mitigate downside risk during periods of market stress. This risk management framework allows us to maintain long-term positioning while navigating short-term uncertainty.

Our tactical equity strategies seek to capitalize on short- to medium-term dislocations and inefficiencies in the market. Leveraging quantitative screens and fundamental analysis, we identify opportunities such as earnings mispricings, sector momentum shifts, and special situations. Each trade is executed within a defined risk budget to ensure tactical moves enhance rather than compromise portfolio stability.

We leverage sophisticated options-trading strategies that enhance portfolio performance while carefully controlling downside risk.

A clear, step-by-step approach to building and protecting your portfolio.

We base every decision on in-depth market analysis, macroeconomic trends, and quantitative models, ensuring our investments are supported by data and expertise.

Our strategies are designed to minimize downside exposure while optimizing returns, safeguarding capital through disciplined diversification and active monitoring.

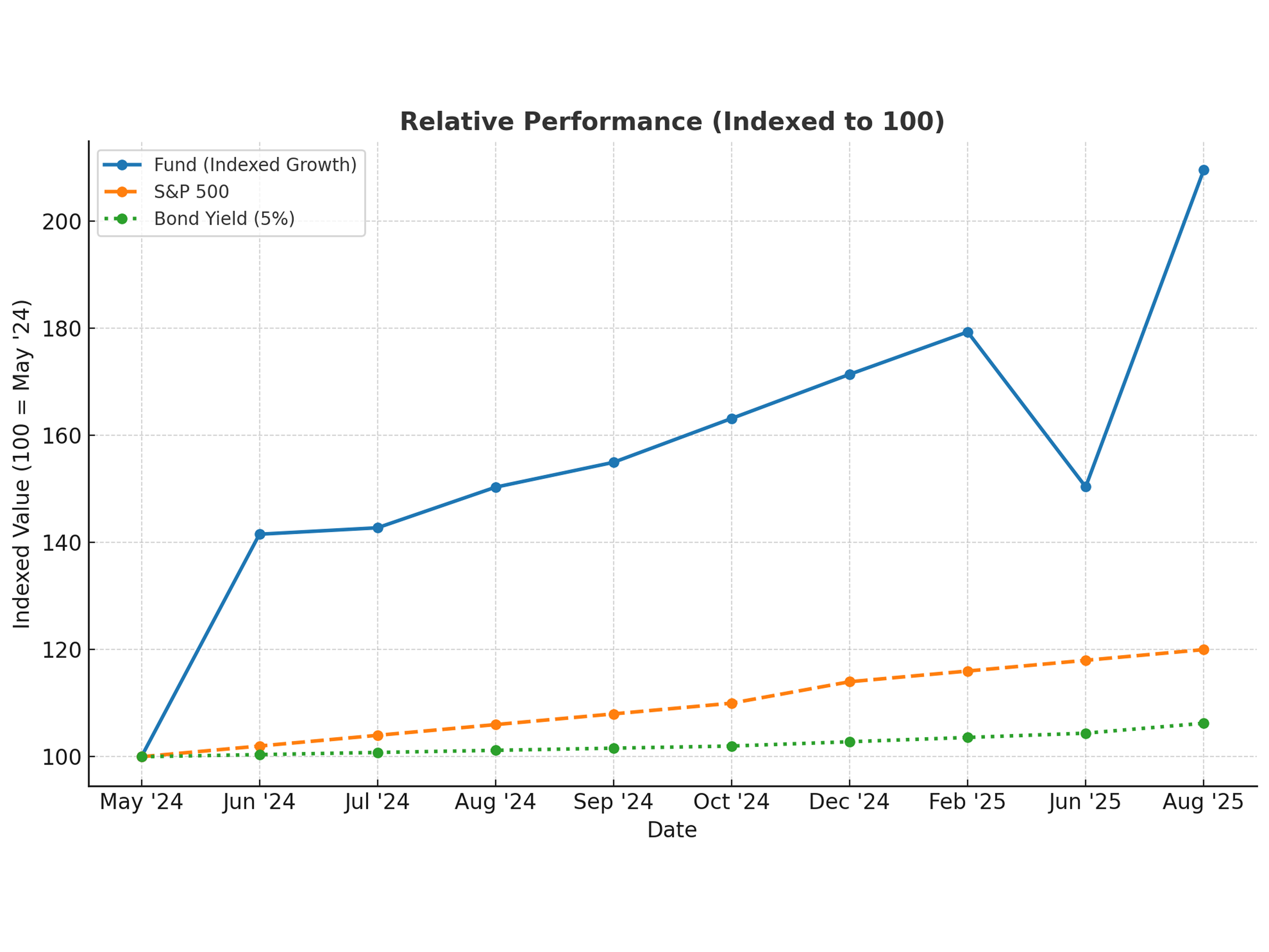

We focus on building long-term value by identifying high-potential opportunities and compounding gains, ensuring steady portfolio appreciation.